Unlocking the Potential of Your Financial Advising Business Through Strategic Marketing

Marketing a Financial Advising business in today's dynamic market requires a blend of creativity, innovation, and strategic planning. It is about crafting compelling narratives that resonate with your target audience, highlighting the unique value propositions that set your services apart. A successful strategy revolves around understanding client needs and tailoring your messaging to address those needs directly. This involves leveraging multiple communication channels to ensure your message reaches your intended audience effectively. Engaging potential clients through educational content and insightful advice can establish trust and credibility, crucial elements in the financial advising landscape. By consistently delivering value beyond expectations, a financial advising business can not only attract but also retain a loyal client base.

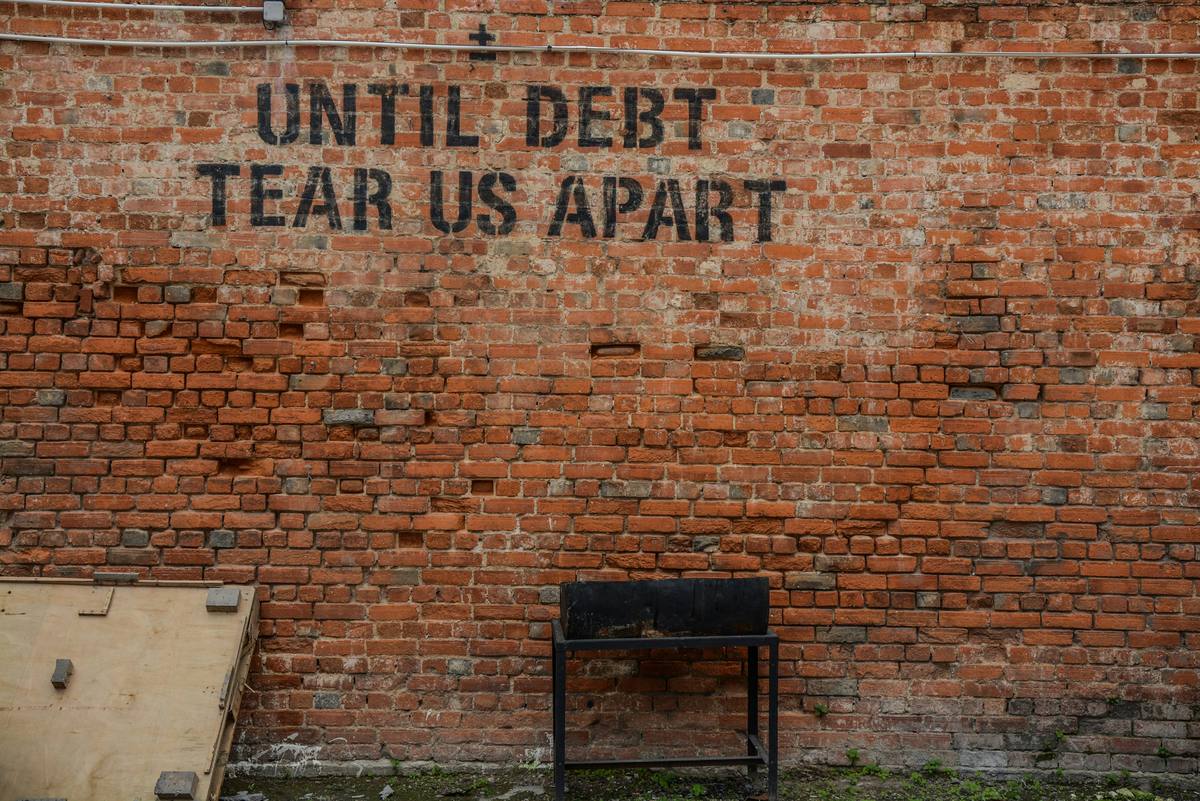

In the realm of Financial Advising, embracing visual storytelling can significantly enhance your marketing efforts. Tools like Desygner offer an intuitive way to create visually appealing materials that capture the essence of your services. Whether it's infographics explaining complex financial concepts or personalized financial plans, visuals help demystify finance for your clients. Including engaging images that align with your brand's story makes your message more memorable. This approach not only aids in simplifying financial information but also in making it accessible to a broader audience. Furthermore, by incorporating consistent branding across all visual assets, you create a cohesive image that fosters brand recognition and loyalty. Visuals are not just adornments; they are powerful tools that can elevate the perceived value of your services.

Did you know that the most successful financial advising businesses aren't always the ones with the best financial strategies, but rather those with stellar marketing tactics? Yes, in this day and age, how to market your services effectively can make a huge difference in your business's growth. Let's dive into some key strategies.

Understanding Your Audience is Key

Your first step in marketing a financial advising business is truly understanding who your audience is. Without this foundation, any strategy you implement may miss its mark. Are they young professionals, retirees or small business owners? Tailoring your message to resonate with your specific audience increases engagement. This personalized approach sets the stage for deeper connections and trust, which are crucial in financial advising.

Embrace Digital Marketing

The digital world offers a plethora of opportunities for reaching out to potential clients. From social media platforms to email marketing, there are numerous ways to spread the word about your financial advising services. Remember, consistency and quality content are key here. It's not just about bombarding your audience with advertising but offering them valuable information that positions you as an authority. Digital marketing, when done right, significantly boosts visibility and credibility.

Blogging: Your Secret Weapon

Blogging isn't just for foodies or travel enthusiasts; it's a potent tool for financial advisors too. By creating informative and engaging blog posts on topics related to finance and investing, you establish yourself as an industry expert. This not only improves your website's search engine ranking but also helps build trust with your potential clients. Blogs are a fantastic way to demonstrate your knowledge and keep audiences coming back for more insights. Plus, they provide great content to share on social media.

SEO: Don't Ignore It

Speaking of search engine ranking, SEO (Search Engine Optimization) cannot be ignored. In today's digital age, people turn to Google for everything -- including finding a financial advisor. Integrating targeted keywords within your website's content helps improve visibility in search results. Moreover, local SEO strategies can help your business stand out in location-based searches; this is particularly beneficial for attracting clients within your area. Remember, the goal is to make it easy for potential clients to find you.

Boost campaigns with 250+ editable templates. Save, reuse, and wield design tools for business growth.

Try it for FREE!Leveraging Social Proof

Social proof such as testimonials and case studies greatly influences decision-making. When prospective clients see others speaking positively about their experience with your financial advising services, it builds credibility and trust. Display these prominently on your website and share them on social media platforms as well. However, always ensure you have permission from clients before sharing their feedback publicly. Authenticity in these testimonials can significantly sway potential clients looking for reliable financial advice.

Networking Still Matters

In a world that's rapidly shifting towards digital communication, never underestimate the power of good old-fashioned networking. Attending industry conferences, community events or even local business meetings can lead to valuable connections. Word-of-mouth remains a powerful tool; hence personal relationships can lead to referrals that no digital marketing campaign could match in terms of trust-building immediately. Plus, interacting with other professionals provides insights into emerging trends and client needs.

Utilizing Tools like Desygner

In the quest of how to market your financial advising business more effectively, leveraging tools like Desygner can be incredibly beneficial. Creating professional-looking graphics for social media posts, advertisements, or even your blog has never been easier with their intuitive design platform. Not only does it save time but it ensures that all visual elements align with your brand identity consistently across all mediums. This cohesive branding helps reinforce recognition among potential clients and strengthens overall marketing efforts.

## The Lifeline of Financial Advising: Mastering the Art of MarketingIn the dynamic world of financial advising, where trust and credibility are as valuable as the advice dispensed, understanding how to market effectively isn't just an advantage--it's a necessity. The financial advising landscape is fiercely competitive and brimming with options for potential clients. In this environment, standing out doesn't happen by chance; it requires a deliberate, thoughtful approach to marketing.Marketing is the bridge that connects your expertise to the individuals who stand to benefit most from it. Without this connection, even the most seasoned financial advisors can find themselves lost in obscurity, their skills underutilized and their potential unfulfilled. It's through strategic marketing that financial advisors can showcase their unique value proposition, build brand authority, and establish the trust that is so integral to fostering client relationships.## A Bleak Horizon: The Consequences of Neglecting MarketingNeglecting marketing in the realm of financial advising isn't just an oversight--it's a recipe for disaster. Invisibility becomes the first harsh consequence. In a digital age where consumers turn to Google searches before making almost any decision, an invisible business is synonymous with a non-existent one. Potential clients won't know you exist if you don't make yourself visible where they are looking.Moreover, without a solid marketing strategy, your business faces the grim reality of stagnation. Growth isn't merely slowed; it's halted, leaving your business gasping for air in an ocean of competitors who are more than willing to take your place in the market. This stagnation isn't just limited to client acquisition; it extends to retention as well. Current clients need to feel engaged and valued--something that effective marketing accomplishes by keeping them informed and connected.Financial advising businesses that neglect marketing also suffer from a crippling lack of differentiation. In a field where services can appear homogeneous to outsiders, failing to highlight what sets you apart results in your business being lumped together with countless others in the minds of potential clients. This perceived interchangeability makes it improbably difficult to attract new clients and equally challenging to maintain the loyalty of existing ones.Lastly, neglecting marketing leads to a devastating impact on revenue. Without new clients coming through the door and existing ones feeling neglected, revenues shrink. This reduction in revenue not only limits your ability to invest back into your business but also places unbearable pressure on operations, potentially leading to cutbacks and downsizing.## The Unmistakable VerdictThe stark reality is that for financial advising businesses, mastering how to market isn't optional--it's foundational. Marketing stands as the pivotal difference between thriving success and dismal failure. It's what enables financial advisors not only to survive but flourish in today's ultra-competitive environment. Ignoring marketing is akin to slowly fading away into irrelevance while embracing it promises growth, visibility, and sustained success.To thrive as a financial advisor today means embracing marketing with open arms; understanding its power and leveraging it effectively is what will set you apart in this crowded space. Don't let neglect be the downfall of your potential; instead, seize marketing as the critical lifeline it truly is for your financial advising business.

Bringing It All Together

In conclusion, marketing a Financial Advising business in the digital age is both an art and a science. The blend of traditional strategies with modern digital tactics can create a robust marketing plan that reaches potential clients where they are most active. The journey to building a strong online presence might seem daunting at first, but by breaking down the process into manageable steps, financial advisors can effectively market their services and stand out in a crowded space.

Understanding the unique value proposition of your financial advising service is critical. It distinguishes you from competitors and serves as the foundation of your marketing efforts. Crafting this message requires deep insight into what your target audience truly values and how your services fulfill those needs better than anyone else. Once articulated, this message should resonate through every marketing channel you employ.

Digital marketing tools have democratized the ability to reach broad audiences with precision targeting. However, the use of these tools must be strategic and data-driven. Analytics play a crucial role in understanding the effectiveness of each campaign, allowing you to adapt and refine your strategy for maximum impact. Engagement on social media platforms, when done authentically, can significantly enhance brand visibility and foster trust among potential clients.

To successfully market your Financial Advising business, consider integrating these key strategies:

- Develop a clear, compelling value proposition.

- Leverage SEO to increase visibility online.

- Engage with potential clients through regular social media activity.

- Create informative content that addresses common financial concerns.

- Utilize email marketing to nurture leads over time.

- Host webinars or workshops to demonstrate expertise.

- Encourage referrals from satisfied clients.

- Design professional-looking marketing materials with Desygner to ensure your brand stands out.

As we've navigated through the essentials of marketing for Financial Advisors, it's evident that a blend of creativity, strategy, and technology is vital for success. Remember, every touchpoint with a potential client is an opportunity to showcase your expertise and build trust. For visually compelling marketing materials that grab attention and convey professionalism, consider exploring what Desygner has to offer. Elevate your marketing game today by signing up at Desygner and take the first step towards transforming your Financial Advising business's future.