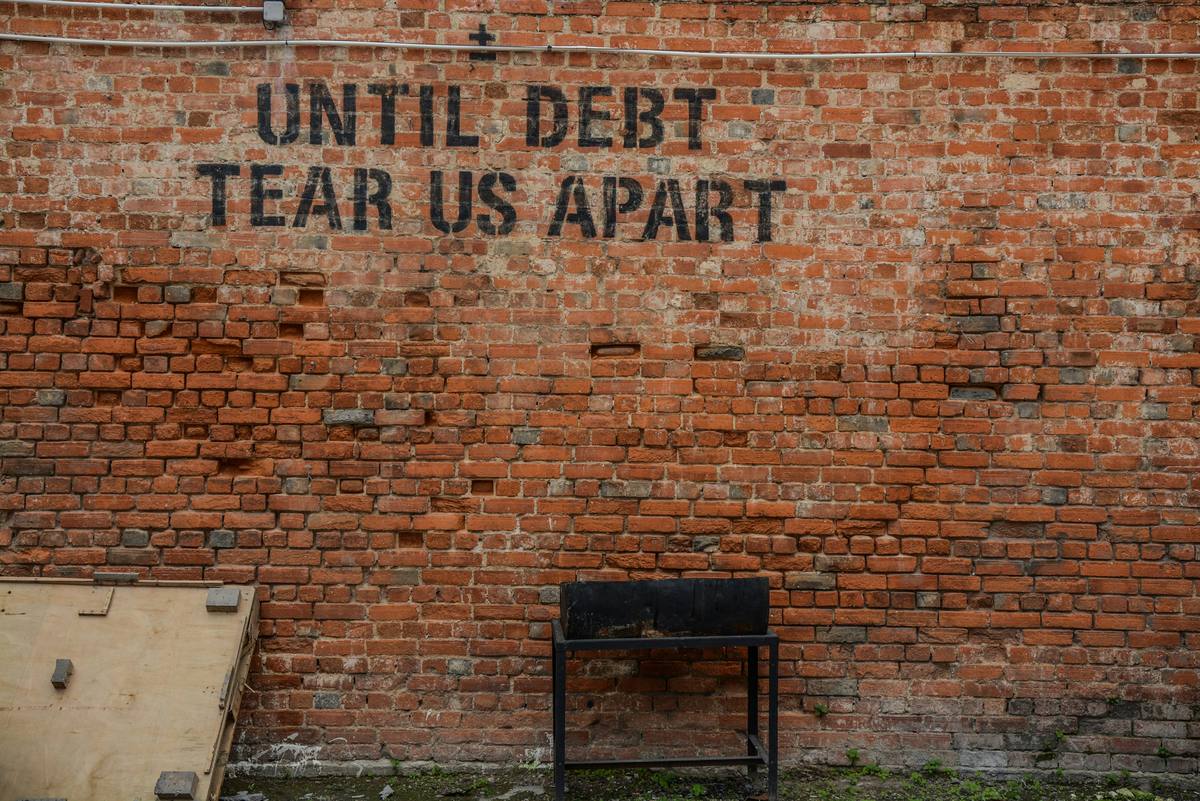

Embarking on Your Debt Relief Services Journey

Starting a Debt Relief Services business is an incredibly rewarding venture for those passionate about helping individuals navigate the challenging waters of financial debt. The initial step involves conducting thorough market research to identify your target demographic and understand their unique needs. Crafting a detailed business plan follows, outlining your services, operational model, and financial projections, which is paramount for clarity and direction. Establishing a solid legal foundation by selecting the appropriate business structure and obtaining necessary licenses is critical in ensuring compliance and fostering trust. Additionally, creating a strong brand identity that resonates with your audience is essential in differentiating yourself in this competitive market. With these foundational pillars in place, you're well on your way to launching a successful Debt Relief Services business.

The Initial Hurdles in Launching Your Business

Embarking on the journey of starting a debt relief services business comes with its unique set of challenges. The first hurdle many entrepreneurs face is understanding the regulatory environment. This sector is heavily regulated to protect consumers, which means navigating a maze of compliance requirements. Additionally, establishing trust with potential clients is paramount; after all, you're dealing with their finances. It's essential to communicate your credibility and reliability from the get-go.

Conducting Thorough Market Research

Understanding your market is crucial in how to start and thrive in the debt relief industry. This means not just knowing your potential clients but also understanding the competitive landscape. What services are others offering? How are they packaging those services? Gathering this information is essential for carving out your unique value proposition in an already crowded marketplace.

Navigating Compliance and Licensing Requirements

The significance of compliance cannot be overstated when it comes to debt relief services. Each state may have its own set of regulations that you need to adhere to. This might include obtaining specific licenses or certifications before you can start operating. Ensuring that every aspect of your business is compliant not only helps avoid legal pitfalls but also builds trust with your clientele. It's about protecting both your clients and your business.

Finding the Funding for Your Venture

Like any business, starting a debt relief service requires capital. Whether it's for licensing fees, marketing, or hiring staff, securing funding is a critical step. Many turn to small business loans, while others might look into angel investors or crowdfunding platforms. It's important to have a clear financial plan and understand exactly how much you need to get off the ground. Careful budgeting at this stage can save you from financial strain down the line.

Crafting a Trustworthy Brand Image

Your brand is more than just your logo or company name; it's everything your business stands for. In debt relief services, building a brand that communicates trust, expertise, and empathy is crucial. This involves everything from how you present yourself online to the customer service experience you offer. Remember, for many people, seeking out debt relief services is a sensitive step; they need to feel assured they're making the right choice. Thus, every interaction should reinforce your commitment to helping them achieve financial freedom.

Boost campaigns with 250+ editable templates. Save, reuse, and wield design tools for business growth.

Try it for FREE!Leveraging Technology in Your Operations

In today's tech-driven world, integrating technology into your operations can provide a significant advantage. From customer relationship management (CRM) systems that help manage client interactions to data analysis tools that offer insights into your operations' efficiency, technology can streamline many processes. Moreover, having a robust online presence allows potential clients to find you more easily. A user-friendly website and active social media channels are now essentials for reaching out to those in need of debt relief services. Technology not only optimizes operations but also enhances client engagement.

Deeply Understanding Your Client Base

To truly succeed in the debt relief business, one must deeply understand their clients' needs and behaviors. Why do they seek debt relief? What are their fears and aspirations? Engaging with clients on a personal level helps tailor your services to meet their specific situations better. This empathy coupled with expert guidance can turn satisfied clients into advocates for your business--a key asset in an industry built on trust.

Utilizing Desygner for Marketing Materials

In promoting your debt relief services business, high-quality marketing materials are vital in capturing attention and communicating professionalism. This is where tools like Desygner come into play; it allows anyone to create stunning visual content without needing extensive design skills. From brochures to digital ads, presenting your services in an appealing way can significantly impact attracting new clients. Plus, keeping branding consistent across all materials reinforces trust--crucial in this line of work. Desygner simplifies this process, making it an invaluable resource for new entrepreneurs.

## The Importance of a Strong Start in Debt Relief ServicesEmbarking on the journey of establishing a Debt Relief Services business is akin to planting a tree. Just as the initial planting and nurturing decide whether the tree will grow strong and fruitful, the way you begin your business profoundly influences its trajectory towards success or failure.### Laying the Foundation for Trust and CredibilityStarting off on the right foot is not just important; it is absolutely crucial in a field as sensitive and impactful as debt relief. In these early stages, establishing a foundation of trust and reliability with your clientele can make an extraordinary difference. A well-thought-out beginning ensures that your clients see your business as a beacon of hope rather than a mere transactional entity. This perception is vital in cultivating long-term relationships that are based on confidence and mutual respect, leading to an ever-expanding base of satisfied customers.### Setting the Stage for Innovation and GrowthMoreover, initiating your debt relief services with clarity and strategic planning allows for innovation to flourish. In an industry where financial landscapes are constantly shifting, being prepared from the get-go empowers your business to adapt swiftly and effectively. This agility can set you apart from competitors, marking your service as not only reliable but also cutting-edge.A well-planned startup phase enables you to lay down scalable systems and processes. These frameworks are essential for managing growth without compromising on service quality. As your business expands, having these systems in place means that scaling up feels less like weathering a storm and more like sailing with a favorable wind.### Enhancing Service Quality and Client SatisfactionThe attention to detail and thoroughness of a well-initiated business directly translates into enhanced service quality. When you start with clear goals, comprehensive understanding of your market, and an unwavering commitment to ethics, it shows in every interaction with your clients. This approach fosters an environment where clients feel understood and supported, significantly increasing their satisfaction.Moreover, starting correctly allows you to identify and leverage opportunities for personalized services. In the realm of debt relief, where every client's situation is unique, the ability to tailor your services can be the difference between good results and life-changing outcomes.### Conclusion: The Ripple Effect of a Well-Planned StartIn conclusion, beginning your Debt Relief Services business with meticulous planning, ethical grounding, and an innovative mindset can create positive ripples that extend far beyond initial interactions. It establishes a culture of excellence that permeates every aspect of your operations, from client relationships to internal processes.The significance of "how to start" cannot be overstated--in many ways, it predetermines not just if your business will survive but how vibrantly it will thrive. A strong start is the seed from which a robust, respected, and revolutionary service can grow--a service capable of truly making a difference in people's lives by offering them not just debt relief but a pathway to financial freedom.

Concluding Thoughts on Initiating a Debt Relief Services Business

Stepping into the world of debt relief services is not only a venture into a financially rewarding domain but also an opportunity to make a significant impact on individuals' lives. As you embark on this journey, remember that the success of your business hinges on thorough planning, unwavering dedication, and a deep understanding of the financial challenges faced by your potential clients.

Building a solid foundation involves more than just understanding the market; it requires creating a robust business plan, adhering to regulatory standards, and fostering trust with your clientele. Moreover, adopting cutting-edge technology and innovative approaches can set your services apart in this competitive field. It's crucial to stay informed about industry trends and continuously seek ways to improve your offerings.

To ensure your debt relief services business stands out, consider these key takeaways:

- Develop a comprehensive business model focused on client success.

- Maintain compliance with all legal and ethical standards.

- Invest in marketing strategies that resonate with your target audience.

- Offer personalized solutions tailored to individual financial situations.

- Stay abreast of technological advancements in the finance sector.

- Build a team of experts passionate about helping others achieve financial freedom.

- Leverage social proof through testimonials and success stories.

- Incorporate tools like Desygner for professional and impactful marketing materials.

In conclusion, while the path to establishing a successful debt relief services business may be challenging, it is undeniably rewarding. By focusing on delivering value and transforming lives, your endeavor will not only be profitable but also highly fulfilling. Remember, as you grow your business, tools like Desygner can play a pivotal role in crafting compelling marketing materials. Consider signing up at Desygner today to elevate your brand's presence and connect more effectively with those in need of debt relief solutions.