Embarking on Your Pensions Business Journey

Starting a pensions business can seem like a daunting task at first glance, but with the right approach, it morphs into an exhilarating adventure. The initial step involves conducting thorough market research to understand your potential clientele and the competitive landscape. This wealth of information will be instrumental in crafting bespoke pension plans that truly resonate with your target audience. Furthermore, it's crucial to navigate the complex regulatory environment with precision, ensuring full compliance and building trust. Establishing robust operational frameworks and engaging digital platforms from day one sets you apart in this digital age. Lastly, an unwavering commitment to providing exceptional customer service will create enduring relationships and foster loyalty among your clientele.

Venturing further into the realm of pensions business requires a keen eye for detail and an innovative marketing strategy. One cannot underestimate the power of a visually captivating brand identity that echoes the core values and professionalism of your business. Tools like Desygner offer an intuitive way to create compelling visual content that stands out in today's crowded digital marketplace. Investing time in developing educational content that demystifies pensions for your audience can position you as a thought leader in the industry. A well-thought-out online presence, combined with strategic alliances, can amplify your reach exponentially. Remember, success in this sector is not just about selling products; it's about educating, advising, and guiding your clients towards financial security. Embrace the journey with passion, and watch your pensions business flourish beyond boundaries.

Understanding the Regulatory Environment

When you're looking into how to start a pensions business, one of the first hurdles you'll encounter is the complex regulatory environment. Pensions are highly regulated to protect consumers' investments, which means there's a significant amount of legal compliance work involved. You'll need to become familiar with both local and national regulations that govern pensions. This not only includes understanding the current laws but also staying abreast of any changes. Failing to comply can result in hefty fines and damage to your business reputation, making it crucial to prioritize this aspect from the get-go.

The Importance of Trust Building

In the pensions industry, trust is everything. Potential clients need to feel confident that their retirement savings are in good hands. Building this trust starts with transparency about your qualifications, the security of the pension schemes you offer, and clear communication about potential returns and risks. It's also essential to have a robust customer service system in place for answering any queries or concerns. Remember, word of mouth plays a significant role in this sector, so happy clients can become invaluable ambassadors for your brand.

Navigating Market Competition

The pension market is fiercely competitive, with numerous established players dominating the scene. As a newcomer, standing out requires offering something unique or improving upon what's currently available. Perhaps it's superior customer service, innovative investment options, or more attractive terms and conditions. Analyzing your competitors thoroughly will help you identify gaps in the market that your business could fill. However, remember that differentiating your services while maintaining profitability is a delicate balance to achieve.

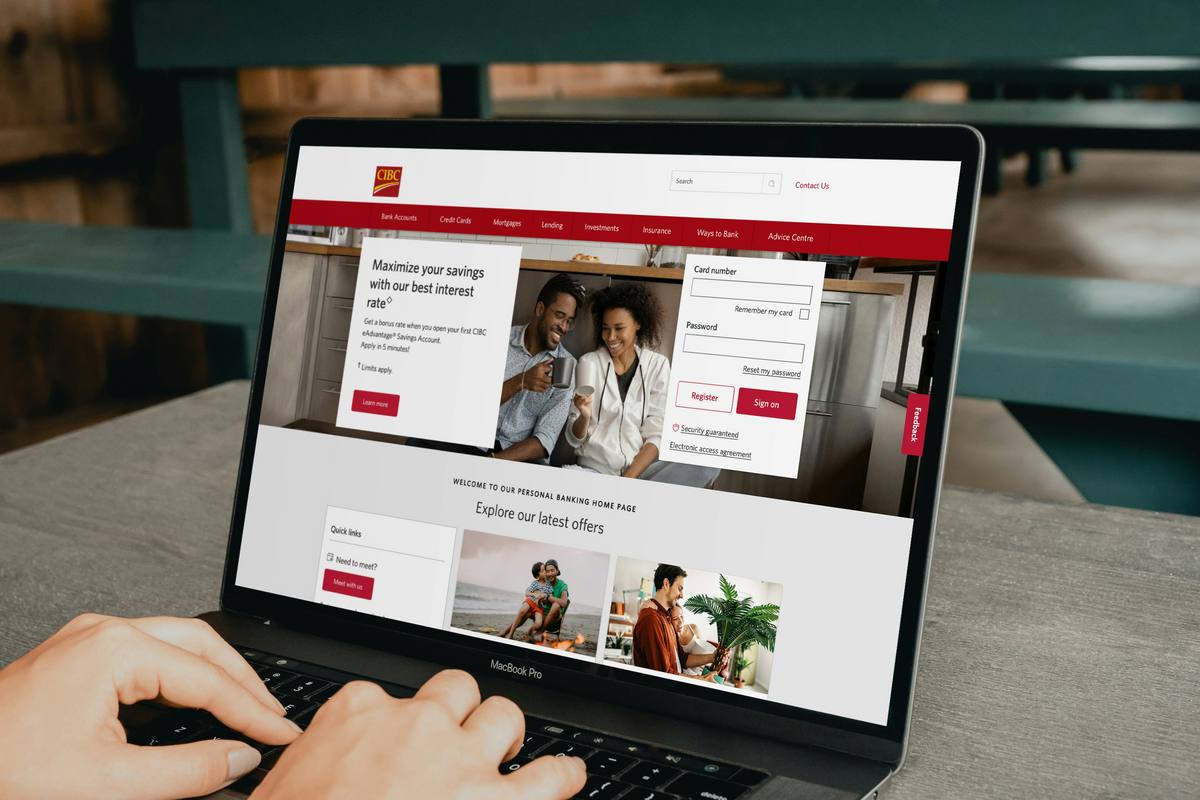

Focusing on Digital Innovation

Digital innovation has become a non-negotiable in almost every industry, including pensions. Today's clients expect convenient online platforms where they can manage their investments without needing to make phone calls or visit offices. Developing such a platform might require a significant upfront investment but consider it essential for long-term success. It's not just about having an online presence; it's about ensuring that your digital tools enhance user experience and engagement. Additionally, leveraging fintech can offer sophisticated solutions like AI-driven investment advice, making your offering even more appealing.

Securing Initial Funding

Figuring out how to start financially is another major challenge when launching a pensions business. You'll likely need substantial initial funding not only for regulatory compliance and setting up your office but also for technology development and marketing efforts. Traditional bank loans may be one avenue, but venture capital or angel investors could also be viable options if you can demonstrate potential for high growth or unique value proposition. It's vital to have a solid business plan and financial projections ready when approaching funders. Keep in mind that securing funding may take time, so patience and perseverance are key.

Boost campaigns with 250+ editable templates. Save, reuse, and wield design tools for business growth.

Try it for FREE!Creating a Strong Brand Identity

Your brand identity goes beyond just your logo or company colors; it encompasses what your business stands for and its values. In the pensions industry, where trust and reliability are paramount, having a strong brand identity can help you stand out. It communicates to potential clients who you are and why they should choose you over competitors. Investing in professional branding services can pay dividends down the line by making your business more recognizable and reputable. Furthermore, consistent branding across all channels increases recognition and helps build trust with your audience.

Building an Effective Marketing Strategy

An effective marketing strategy is crucial for spreading the word about your pensions business and attracting clients. This involves identifying your target market, understanding their needs and preferences, and determining the best channels to reach them--whether through social media, content marketing, email campaigns, or traditional advertising methods. Personalization can significantly increase engagement rates by making potential clients feel understood on an individual level. Analytics play a crucial role here as well; tracking campaign performance allows you to adjust strategies as needed for better results over time. Remember: marketing is an ongoing process that should evolve with your business and customer base.

Leveraging Design Tools Like Desygner

In today's visually driven world, how you present your pensions business can greatly influence perception and decision-making among potential clients. That's where tools like Desygner come into play; they allow businesses of all sizes to create professional-quality graphics without needing extensive design skills or resources. Whether it's creating engaging social media posts, informative brochures, or impactful presentations, Desygner offers an accessible way to ensure your visual content stands out from the competition. By streamlining design processes, it also frees up valuable time that can be spent on other aspects of growing your business. Leveraging such tools effectively can provide a competitive edge in communicating value propositions clearly and memorably.

Gracefully Starting Your Pensions Business: A Summary

Embarking on the venture of starting a pensions business demands a comprehensive blend of industry knowledge, strategic planning, and a keen eye for detail. It's not just about setting up shop; it's about fostering a company that can stand the test of time, adapt to regulatory changes, and meet the evolving needs of your clientele. Following these guidelines can set you on a path to success.

First and foremost, understanding your market is critical. This includes recognizing the demographics of your potential client base, their needs, and how best to address them. Building a robust business plan cannot be understated, as it not only guides your journey but also attracts potential investors and partners. Additionally, staying abreast of legal requirements and obtaining the necessary licenses is imperative to operate your business within compliance and avoid costly penalties.

Digital marketing strategies should not be overlooked in today's tech-savvy world. Establishing a strong online presence through a well-designed website and active social media accounts can significantly enhance your visibility and attract more clients. Furthermore, leveraging technology to streamline operations will ensure efficiency and improve customer satisfaction.

Consideration for the following bullet points can further refine your approach:

- Analyze competitor strategies and find your unique value proposition.

- Engage with financial advisors for expert insights.

- Prioritize customer service to build trust and loyalty.

- Implement an effective CRM system for client management.

- Educate your audience with valuable content related to pensions.

- Invest in professional development for you and your team.

- Maintain flexibility to adapt to industry changes promptly.

- Use Desygner for creating marketing materials with ease.

To conclude, starting a pensions business is indeed challenging but equally rewarding with the right approach. By focusing on thorough market research, solid business planning, compliance with legal standards, and adopting modern digital strategies including using tools like Desygner for your marketing needs, you'll pave the way for a successful venture. Encourage yourself to take this step towards creating a legacy in the pensions industry by signing up at Desygner today!